Getting a home mortgage can be tough for a lot of people because they don’t understand how they work. This article can teach you what home mortgages. Read on to learn more about getting the right loan product for you.

Prepare yourself for your mortgage in advance. Get your budget completed and your financial documents in line before beginning your search for a home and home loan.You should have a healthy savings account and reduce your debt. You will not be approved if you don’t have everything in order.

You have to have a lengthy work history to get a mortgage. The majority of lenders want to see no less than two years’ worth of stable employment to grant approval. Switching jobs a lot can result in your loan being denied. If you’re in the process of getting approved for a home loan, make sure you do quit your job during the process.

Get pre-approved for a mortgage to find out what your monthly payments will cost you. Comparison shop to figure out a price range. Once you have everything figured out, it will be easy to figure out your monthly payment.

Don’t give up hope if you have a loan application that’s denied. Every lender has it own criteria that the borrower must meet in order to get loan to. This is the reason why it will benefit you should shop around to many different lenders to better your chances of getting a more than one lender.

It is advisable that you remain in contact with your lender, even when your finances are in trouble. A lot of homeowners throw in the towel when their luck goes south, but the wise ones remember that lenders are often willing to do a loan renegotiation instead of watching it sink. Call your mortgage provider and see what options are available.

There are some government programs that can offer assistance to first-time home buyers.

Educate yourself about the home’s history when it comes to property tax. You should understand just how much the property taxes will be before buying a home.

If your home is not worth as much as what you owe, refinancing it is a possibility. There is a program out there called HARP that helps homeowners renegotiate their mortgage despite how much they owe on the property. Speak to a lender now since many are open to Harp refinance options. If your current lender won’t work with you, find a lender who will.

Make extra payments if you can with a 30 year term mortgage.This will help pay off your principal.

Your balances should be lower than half of your total credit limit. If you can get them under thirty percent, a balance of under 30 percent is preferred.

You probably need a down payment. Some banks used to allow no down payments, but now they typically require it. Consider your finances carefully and find out what kind of down payment you will need to provide.

Reduce debts before starting the home buying process. A home mortgage is a huge responsibility and you want to be sure that you will be able to make the payments, and you should be able to comfortably afford it. Having fewer debts will make it easier to do just that.

Adjustable rate mortgages don’t expire when their term ends.The rate is adjusted accordingly using the rate at the time. This is risky because you may end up paying a high rate of interest.

Gather all needed documents for your mortgage application before you begin the process. This information is vital to the mortgage process that your lender will look at. These include your W2s, pay stubs, income tax returns and bank statements. By gathering these documents before visiting the lender, you can speed up the mortgage process.

Think outside of banks for mortgages. Credit unions are another great rates.Think about your options available when looking for a home mortgage.

Avoid Lenders

Consider hiring a professional to assist you in the process of procuring a new home loan. They will help you get a great rate. They will also make sure that your terms are fair.

Learn how to detect and avoid a shady lenders. Avoid lenders who talk you the world to make a deal. Don’t sign things if rates are too high. Avoid lenders who say there is no problem if you have bad credit isn’t an issue.Don’t do business with anyone who says lying is okay either.

Many brokers can find a mortgage that fit your circumstances better than traditional lender can. They work together with various lenders and can help you make the best decision.

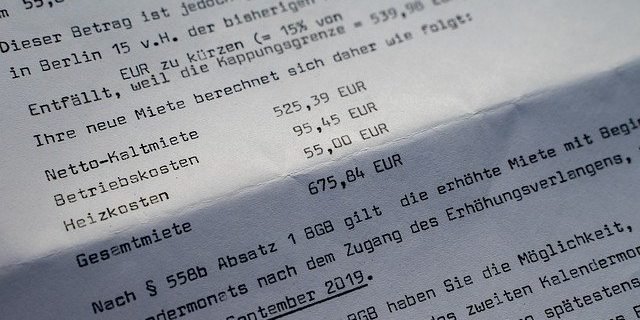

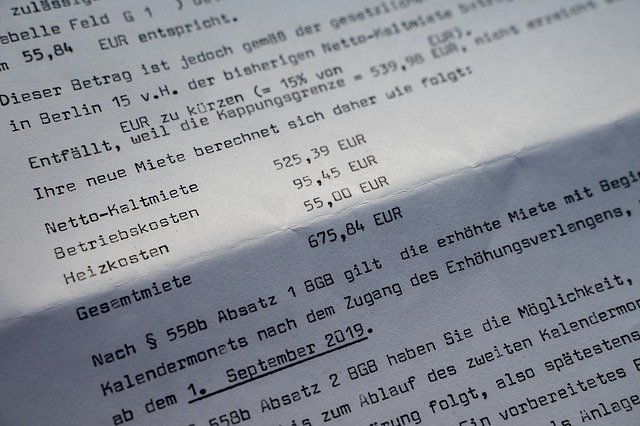

Pay attention to interest rates. Although interest rates have no bearing on the acceptance of a loan, it does affect the amount of money you will pay back. Play around with the numbers to see how different interest rates will alter your monthly mortgage payment. Do not sign your mortgage loan documents until you understand exactly what your interest expense will be.

Lower your number of credit accounts prior to purchasing a mortgage. Having lots of open credit cards can make it seem to people that you’re not able to handle you finances.

Learn all the typical costs and fees associated with your mortgage. There are so many strange line items when it comes to closing on a mortgage. It can be quite confusing and stressed. However, with the proper legwork, you will be more prepared to negotiate intelligently.

If you are having troubles with your mortgage, get some help. If you have fallen behind on the obligation or find payments tough to meet, see if you can get financial counseling. HUD-approved counselors exist in most regions. Free foreclosure-prevention counseling is available through these HUD-approved counseling agencies. Look online or call HUD to find the nearest office.

Look to the internet for your mortgage. You used to have to get a mortgage companies but now you can contact and compare them online. There are many reputable lenders online that only do their business exclusively online. They often have the best deals and they are able to process loans more quickly.

Make sure your credit report looks good order before applying for a mortgage loan. Lenders want customers that have great credit.They need to have reassurance that you are able to pay them back. Tidy up your credit before you apply for a mortgage.

Reduce debts before applying for a mortgage. A mortgage is a large responsibility. You need to be certain that you can consistently, regardless of circumstances. You’re going to have a much simpler time accomplishing this if your debt is minimal.

Many people have no idea how to obtain financing. While getting a mortgage is a fairly complex process, don’t let it overwhelm you. Print out this article and read it again and again so that you can prepare yourself for getting the loan you need.