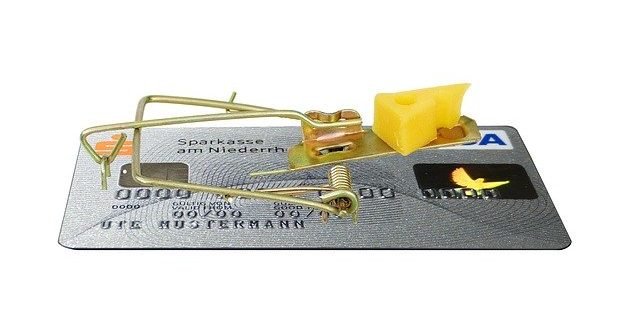

There are times when events cause financial turmoil.Your paycheck might not be enough to cover the cost and there is no way you can borrow any money. This is when a payday loan could be the best option. You must get all pertinent information before accepting an offer from a cash advance loans in this article.

Always know the money you have to pay for the loan. You might want to get your money and go, but you need to know what you have to pay later. Be certain the payday lender gives you a list of all pertinent fees. If you understand all of the terms involved, you can help keep your repayment expenses to a minimum.

If you’re taking out a payday loan, remember that your next paycheck is probably gone. Not considering this is what gets many people into a never-ending payday loan can be detrimental to your future funds.

Regardless of what happens in your life, if you must resort to a payday loan, don’t get more than one at any given time. Work on getting a loan from one company instead of applying at a ton of places. This will put you in a place where you won’t be able to get the money paid back, no matter what salary you’re making.

Not all payday loans are the same. You need to educate yourself about as many lenders as you can so that you can get the best rate.

Avoid jumping in the car and driving to the first place that offers payday loans. While you may drive past them often, there may be better options if you take the time to look. A little homework can save you a lot of money.

Payday cash advances can provide a good option for those who need cash and have no other options. People should understand what they are though before applying for one. Interest rates are often quite high and accompanying fees may make such loans difficult to repay.

Evaluate alternative lending options before deciding to apply for a payday loan. It is a wiser choice to borrow emergency funds from a friend or relative. It can also work well to get a loan from your bank or to use a credit card. Yes, most of these options have fees associated with them, but they will be a fraction of the fees associated with a payday loan.

Do some shopping around in order to get the lowest interest rate.There are traditional payday loan businesses located around the city and some online as opposed to an actual store that you physically go into. They are all in it for the best rates. Some lenders also offer a considerable discount for first time. Check all your options prior to choosing a lender.

If you must get a loan, shop around before making a decision. It’s likely that you feel extremely stressed out and want money as fast as possible. However, if you take the time and look over a few different companies that offer loans, you may find one that offers better deals. This ensures you’ll be ready for anything.

If you cannot repay the loan when due, call the company as soon as possible to ask if they will give you an extension. You might find your payday loan company to allow you a one or two day extension. Just keep in mind that you may have to pay more when you obtain an extension.

There are many penalties for not paying on time, and you should be aware of this. While you surely intend to pay the loan in a timely fashion, you may run into trouble. It is essential to read the terms of the loan so that you understand the late fees you may face. The fees can be really high with payday loans.

Payday Loan

If you live an area where no payday loan companies operate locally, look online for reputable companies that will work with you long distance. Find a state that allows payday loans and make a trip to get your loan. And, since most loans are recovered electronically, you will only have to make one trip.

Shop around before deciding on who to get cash from when it comes to payday lender. Some lenders will have better interest rates than others and could also be more legitimate. Some payday loan agencies might give you the money right there, while others may make you wait a few days. Shop around and compare interest rates to find the right payday loan for you.

A great tip for those of you looking to take out a payday loan is to find a lender that is not opposed to working with you if any hardships come your way when it is time to pay back your loan. There are places out there that can give an extension if you’re not able to pay back the payday loan in a timely manner.

Only apply for a loan directly from the lenders themselves. There are many sites out there that will take your information and try to match you with a lender, but using them is ill advised given the information you have to reveal about yourself.

As you are considering taking out a payday loan, be sure you will have the money to repay it within the next three weeks. If you are in need of more money than what you can repay in that time period, then check out other options that are available to you. Short-term loans for relatively low amounts of money do not have to be payday loans. Browse alternative options before you decide to go with a payday lender.

If a payday loan is something that you are going to apply for, it is wise to borrow the smallest amount possible. A lot of people need cash for emergencies, but you need to understand that a cash advance loan is very expensive compared to a credit card even! Keep costs down by keeping your amount possible.

If you find that you own multiple payday loans, you should not attempt to consolidate them. You simply won’t manage to pay off a huge loan like that. See if you can pay the loans by using lower interest rates. This will let you get out of debt quicker.

Learn your experience regarding cash advance loans.You can use these feelings to motivate yourself to start an emergency savings account, meaning you do not need to turn to a payday loan anymore.

Friends and family are a good source to go to for money before taking out a loan. If you cannot come up with the entire amount this way, you can still apply for a payday loan to cover the difference. Also, you can limit the amount of interest that will pile up on you.

Avoid getting into a never-ending debt cycle. Make sure you are not taking out a loan in order to pay another one off. You have to get out of the cycle even though you may have to give up some comforts. It is way too easy to get sucked into the cycle of debt if you are not careful. This could cost you quite a good deal of money within a short period of time.

If you’re going to get a loan from a payday company that is far from you, try to look for someone that will not require you to use a fax machine. Faxing can be difficult as many people don’t own fax machines. This means you’ll have to head to Kinko’s or some other shop and pay between $1 and $5 per page to fax in the information. You might as well save yourself the headache and find a no-fax lender.

Every state has different law concerning cash advances. Your lender has to be licensed to be able to operate in your state.

You need to take care and avoid scammers that operate under the disguise of an online payday lender. Often these scammers can be identified by having names similar to reputable companies, offering loans by telephone, or telling you they do not care about your credit rating. Their goal is to get information from you for unethical purposes.

When getting through a financial crisis, you need to focus on avoiding any more financial emergencies. Don’t assume everything is fine just because random things can happen at the moment.You have to pay the loan.

You can also use a payday loan company to help manage money. The extra money can help you create a budget that will help you in the future. This loan could actually be a sound financial decision in the end. Using common sense is the most important thing to keep in mind.

Before you go with a payday loan, make sure that you fully comprehend the entire contract.

If you should find yourself in need of a payday loan, make sure that you pay the loan back completely on your next payday or by the due date. It is vital that you do not roll over the loan again. This will help you avoid excessive costs that will quickly add up and keep you in debt longer.

This could save you a good chunk of money in the long run.

Pass on any payday lender that charges you more than 1/5 of the loan amount in processing fees. This is a very large amount and you should go with another company.

If you are self-employed, consider a personal loan before a payday loan. This is because cash advance loans generally aren’t granted to self-employed people. Payday loan lenders will have a regular paycheck coming to repay the loan.

Go online before getting a payday loan. Only use a trusted company that you have heard about from a friend or read reviews about. Applying for an internet-only payday loan involves applying on their website. Most online lenders can approve you within 24 hours.

Don’t take out another payday loan if you’ve failed to repay the first one as promised. You might think you need the funds, but it should be obvious that you are digging yourself into a deeper hole with each new loan you take out.

Getting a payday loan should not be your primary resource when you need money. It is okay to use this resource occasionally, but it should never be a consistent means of obtaining funding. Instead of having to rely on these sort of high risk loans, try putting aside money every month just in case you have an unforeseen emergency or added expense in the future.

Check online forums for reviews of reputable payday loans. This will help steer you figure out which companies are trustworthy and away from the scammers.

Prior to signing an agreement, make sure you understand how much money you’ll be able to borrow. Avoid borrowing more money than you need just because it is available to you. By doing some research, you could avoid wasting a lot of time that will not offer you the money you need.

You need to be careful when it comes to scammers that are associated with the payday loan industry. Many times, scammers will use names that are very similar to reputable businesses, offering you quick cash over the phone and saying your credit hsitory does not matter. They will try to get your information so that they can take advantage of you.

If you need a payday loan for solving a money crisis, make a commitment to starting a budget. You have to monitor your spending so you never have to take out such a loan again.

Try to talk to a payday loan. While online applications may seem easy, it is usually better to call for more information. You may ask questions and understand the contract fully.

Make plans to pay back your payday loan as quickly as possible. Paying off a payday loan before it is due may give you piece of mind but it will not save you money on interest or fees.

Payday loan rates are quite high, but a fee of 20 percent or more is too much to pay.

If you are considering a payday loan, it is important to read the contract completely. The terms of the loan, the due date and the annual percentage rate are some of the things that will be spelled out in the payday loan documents that you sign. In addition, you need to sign and date the document, along with the loan officer.

You don’t want to delay the process by simply forgetting to send a key piece of information. It could delay the cold for up to two days.

Ask the payday loan company what information they need if you work for yourself. You can still get a loan, but it works a little but differently. Consider calling up customer support and get a person to assist you in filling out this paperwork so that you won’t make any errors.

What was your emotional reaction? Did you feel relief when your financial emergency was now taken care of? Or did you just secured extra money? If you just want quick satisfaction, you could be susceptible to payday loan addiction, and you should look for help to prevent yourself from getting this addiction.

Usually payday loans are easy and quick to get. They do, however, cost a lot. To get dollars you require at a better interest rate, or perhaps none at all, think about asking friends and family for help. This can help you get the money you need without high interest rates.

Although you should not make taking payday advances out a habit, they can be very helpful if you have urgent costs that you cannot wait to pay. If you use these loans with care, you can avoid problems. Apply these tips to make the best decision possible.

Payday loans may make sense when you do have money, but accessing it would be costly. For instance, say your money’s in the form of Certificate of Deposits. Using this money would end up costing you more than if you were to just get a payday loan. If you pay your loan back in a timely fashion, you will have saved yourself the higher interest rate of accessing your retirement funds while handling your current financial difficulties.