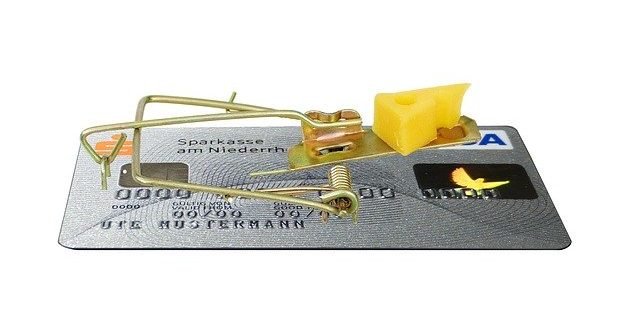

There are a lot of reasons why people have financial difficulty. Sometimes financial situations arise that they have to borrow money to take care of them. One quick source people use for loans can be a payday advances. The following information contains tips associated with payday loan is right for you.

Know what the company wants to charge you before you take out the loan. The interest fees can be surprising to many people. Don’t be afraid to inquire what the interest rates for a payday loan are.

Make sure that you know the terms of a loan before you sign any paperwork.It is not uncommon for lenders to expect you to be employed for no less than 3 months.They need proof that you’re going to be able to pay your loan note.

A large lender will offer you better terms than a small one. Indirect loans cost a lot more in fees because they need to keep some of the money so they are able to make a profit whenever you pay it back.

Do not be surprised if the loan company requests information on your bank information. A lot of people don’t go through with getting the loan because they are wary about giving out their bank account number.The idea behind payday loans is that the company auto-debits the money from your next paycheck.

If the day comes that you have to repay your payday loan and you do not have the money available, ask for an extension from the company. Payday loan companies may offer you one or two day extensions. Understand, however, that you will have to pay interest.

Bad Credit

Make sure you check out several payday loan companies first. Some may offer lower interests rate or lower fees so you should weigh your options before deciding on one. One place may be able to fund the loan within an hour, or you may wait for days at another. Shop around to find the right payday loan for you.

Even people with bad credit can be approved for a payday loan. Many people who really could benefit from these loans don’t even bother applying due to their bad credit rating.

Be sure to give payday lenders the appropriate information. You’re going to need to provide them with a paycheck stub or some other proof of income. Make sure to give them the correct phone number too. If you provide incorrect information or you omit necessary information, it will take a longer time for the loan to be processed.

If you find that you own multiple payday loans, don’t attempt to consolidate the loans together into one big loan.

A poor credit score usually won’t prevent you from taking out a payday loan. Tons of people that need a payday loan don’t get one because they’re afraid that their credit isn’t good enough. Many firms will give anyone with a job a loan.

Do your homework before signing up for a payday loan. You might think you don’t have time to do this because you need money as soon as possible. Payday advances are known for being very quickly. You might be able to get the money on the very day you take out the loan. Look online for low rates, customer testimonials, and find other options that will let you find the money that you need.

One thing you will want to ascertain when working with a payday loan servicing company is what rules they have in place to help out if you have further problems and cannot pay the loan back as agreed. Such lenders will offer more time to pay if things get tough.

Payday Loan

Those planning to get a payday loan must plan ahead prior to filling an application out. Some payday loans are better than others when it comes to terms and conditions. Before you get a payday loan, look at the terms and conditions and interest rates.

Think about what you’re about to do before choosing to take a payday loan. Know that most loans charge an average APR on a payday loan is between 378-780%. Consider that borrowing $500 or so for a mere two weeks could cost you an additional $125. If this is the only thing you can think of to get money now, the price may be justified.

As you work on your budget following a financial emergency, you must work hard to steer clear of future cash crunches. Never make the assumption that all will be okay just because things are fine right now. Remember that money must be repaid.

Don’t take out another payday loan on top of another one as promised. You may have a genuine financial emergency, but it is important to consider your past experience.

Be honest on your loan forms. You might think that this will help you get the loan, but payday loans prey on people that do not have good credit and that do not have a good job. If you are found to have lied on your application, you will jeopardize your ability to get future loans.

This is a good way to steer clear of the most common loan scams.

You should realize that payday loans may be unavailable to the self employed. A lot of loan companies will call your boss to verify that you work there, so do not lie. Self-employed borrowers should first find a lender that will consider self-empoyment as a reliable source of income.

You must understand that cash advance loans are a short-term solutions. If you could not afford paying your bills and you don’t have money set for emergencies, you may need learn to budget your money better.

There are many scammers that claim they are payday loan companies. Many times, scammers will use names that are very similar to reputable businesses, and will try to get you to apply for a phone over the phone or claim that credit is not an issue. At best they will sell your personal information, at worst they will use it for identity fraud.

Only go with a company that is honest about the fees and rates on payday loans. Stay away from companies that try to hide their loan fees and costs.

See what the fees are for taking out a payday loan. Even though you may see a lot of reports regarding the high price of such loans, there are times when you really need the money now. Payday lending involves smaller amounts that range from one to several hundred dollars. You might pay as much as 30 percent on a loan of 100 dollars. If you can swing this payment go for it, if not turn around!

Don’t sign a contract until you carefully read the contract. Read the terms of the loan and ask any questions you have. Look elsewhere if you’re confused or see hidden charges and wordy terminology that may mask questionable fees.

Don’t roll over a payday loan unless absolutely necessary. Repetitively refinancing payday loans can cause a snowball effect of debt. Due to the size of the interest rates, a loan can become unmanageable very quickly. If you anticipate difficulty repaying a payday loan, try to get a small personal loan at a bank or from family.

Payday loans should only be used for major emergencies. They shouldn’t be used for situations where you shopping money. If money is tight, it is better to try to get a loan from a bank or other financial institution to avoid having to roll over the payday loan multiple times.

Explore other options before applying for a payday loan. In addition to borrowing from friends, you might ask your existing creditors to adjust your current payment plan. Payday loans ought to be thought of as emergency options only, and you should always have some reserve funds available.

Getting cash advance loans shouldn’t be your only option when you need money. It is okay to pursue one loan, but it should never be a consistent means of obtaining funding.

When you apply for a loan, make sure you understand the interest and fees you’ll be required to pay. If you spend sufficient time reviewing the details of the loan you can steer clear of unexpected surprises.

If a payday lender refuses to lend to you, inquire as to the reasoning behind it. It could be something as basic as your employer not answering the phone. Once you know why you were denied, you can correct the problem and reapply. This will help you the money that you require for your circumstance.

Have you seen ads on TV for no credit loans? In many cases, though, you will be denied loans if your credit is bad enough. Having no credit isn’t the same thing as having a bad credit standing. Remember your credit situation before applying for a loan.

There are situations in which there is nowhere to turn but to a payday loan. If this is the case for you, you must check out the company that has the loan you want. If their reputation is poor, then look to another company to get money from.

Individuals who find themselves in urgent need of funds may have no other option than to take out a payday loan. If you need this money, do your research before you begin the application process. Try to find a company that has a great reputation so that you can feel confident.

You should know whether or help your credit. You cannot expect your credit score to increase, but it could be impacted if you miss a payment. Make sure you can pay your payday loan back on time.

Just as you would with any financial endeavor, be sure to read everything before you sign the paperwork. If you fail to read the contract, you may find yourself in a difficult financial situation. Make sure to read the entire contract and don’t hesitate to ask about anything that confuses you.

You may feel a serious financial crunch, but if you are not able to pay it back in a few weeks, you might get a lot of penalties that would make your situation a lot worse.

There may be a time in your life where an emergency occurs and you have to have an additional source of money. In some cases, quick cash can be a lifesaver. Be careful to avoid making a habit, of using a payday loan for anything unexpected.

The payday loan and cash advance business makes millions upon millions of dollars a rich one.This is because those in the lender could achieve big profits. Do a little research on each lender to get the best terms available.You should consider all fees that are associated with the loan to make sure it is still worth it.

If your mind is not made up about payday loans, take all the time you need to make your decision. The process of getting this type of loan is quick; once you get your application approved, you will then get the money within twenty-four hours and you must pay the money and interest back.

You are now ready to start looking for a payday loan. You do not have to let your financial problems get the better of you. You only need to find the nearest lender to apply for the payday loan, and your immediate problem can be solved.

If you already have one payday loan, do not get another one to help you get out of repaying it. In the midst of a financial crisis, it might seem alluring, but it’s never a good idea. You will have a more difficult time paying back two loans. Never take out more than one payday loan.