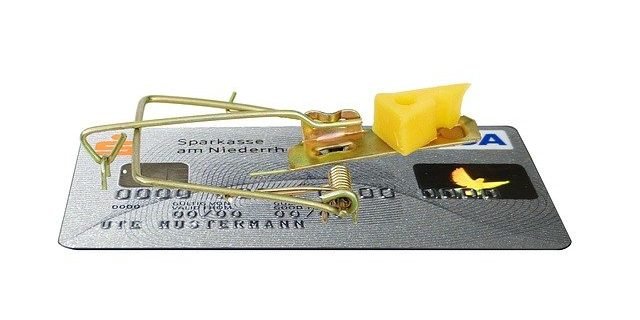

There are times when paychecks are not covered by your paycheck. A quick way to get money is through the use of a payday loan, but they shouldn’t be taken out lightly. This article can help you get the most out whether this is an appropriate solution for your short-term needs.

Research adequately. Don’t just get a loan with the first company you find in the phone book. Try to check out different places in order to find good rates. While it may take you a little extra time, it could save you quite a bit of money in the long run. You may even be able to locate an online site that helps you see this information at a glance.

There are many situations where a payday loan. If you have friends or relatives who might have the resources to assist you, it is best to ask them first before resorting to getting a payday loan.

The amount of money you qualify to borrow through a payday loan varies. Generally, what you make each month at your job is the determining factor. The lender will do the math and crunch the numbers about how much you can borrow based on your earnings. You must realize this if you wish to take out payday loans for some things.

Don’t go to a number of cash advances.

Check out different lenders before you decide where to get a payday loan. Some might offer lower interest rates than others, while others might waive fees for taking the loan out in the first place. Some services will give you the money right away, while others require you to wait a day or two. By comparison shopping, it is possible to get the right loan for your distinct needs.

Cash advances can provide a solution for people who are in desperate need cash and have no other options. People need to understand what is involved in a payday loan before signing up and getting the cash. The exorbitant interest and fees are typical of these loans can make repayment difficult.

In the event that you have over-utilized the services of payday loan companies, a few organizations may be able to help you. They’ll work with the firm to reduce what you owe so you can finally pay it off.

A useful tip for payday loan is to make sure that everything on your application is truthful. You may be tempted to lie a little to make your chances of getting the loan better, but you may end up with jail time instead.

There is required documentation for you to receive a payday loan. Most companies just require proof of employment and bank account information, but this could vary per company. You need to call the firm up before you go to find out what you should bring with you.

Be wary of payday loan companies.There are organizations and individuals out there that set themselves up as payday lenders only to rip you off.

A good tip is finding a payday lender that will work with you in the event you are having a hard time paying back your loan in a timely manner. Some understand the circumstances involved when people take out payday loans.

Payday Loan

Learn about the payday loan fees prior to getting the money. There are a variety of fees which could be charged. For example, a $30 start-up fee is possible. That interest rate is nearly 400 percent. If your next paycheck won’t cover your payday loan repayment, your fees will skyrocket.

Be certain you have the funds on hand when your payday loan comes due. Missing payments does not prevent the lender to find other means to get what you owe. Your bank might hit you with fees and then you’re going to have to pay even more to a payday loan company. Be sure that money in your account so things are kept under your control.

Always know as much as possible about the payday loan agency. Understand all of the terms and conditions before signing for any payday loan. You need to know all about the agent before signing with them.

A great tip for those of you looking to take out a payday loan is to find a lender that they identify lenders willing to negotiate extensions if repayment becomes problematic. Some lenders are willing to extend your loans if you cannot pay them on the repayment date if you find that you’ll be unable to pay the loan back on the due date.

Do some comparison shopping. Check online and local lenders to see which companies are offering the best deals. This can help you save a lot of money.

Be sure you know the amount your payday loan will cost you. It is no secret that payday loan lender charge extremely high rates and fees. They may also tack on administration fees for taking out a loan.The fees are hidden in small print.

Look at the APR that a payday loan company is trying to charge you before you decide about getting a loan from them. The APR is very important because this rate is the actual amount you will be paying for the loan.

Make sure you know about any rollover type payment setups on your account. It may be the case that your lender has a system that automatically renews your unpaid loan and fees are deducted from your bank account. Know what you’re getting into.

If you’re self employed, you may want to think of getting a personal loan rather than a payday loan. This is due to the fact that payday loans are not often given to anyone who is self-employed. Payday lenders require documentation of steady income, and freelancers can rarely provide this, meaning proving future income is impossible.

False Information

Research all the options before you request a payday loan. You may think it’s a waste of time to do some research because you really need the cash now. The good thing about payday loans is getting the cash very fast. A lot of the time you can get your money that very day. There are a number of places you can check to ensure that the company you are working with has a good reputation.

Do not give any false information on your application for a payday loan application. You may think it will help you secure the loan, but payday lenders are geared towards helping people with low credit scores and less stable jobs. It will also hurt your loan prospects if you put false information on the loan application.

Take a solid ten-minute break to think about what you are doing before you finalize the arrangements for a payday loan. Although a payday loan may be your final choice, many people acquire one just to be safe. Let the surprise of an unexpected event wear off prior to agreeing to this loan.

Getting cash with a payday advances are something to take very seriously. You might have serious issues with both your credit and bank if it’s not handled correctly.Always understand that payday advances are not giving you extra cash. You might have to get it from somewhere later on.

You only need go on the Internet to find a payday loan. Find a company that you can trust, either because it was referred to you by a friend or you have read multiple reviews on the business. When you apply for a payday loan online, you can usually get the funds in 24 hours or less.

You should always pay the loan back as quickly as possible to retain a good relationship with your payday advances. This will allow you can get a future loan for the amount that you receive. Use the same company each time you take a history of payment.

Before you accept an offer for a payday loan, make sure you completely understand the interest rate and other fees that you will be charged for this type of loan. Be sure that you understand the fine print and how the costs are calculated.

Don’t take out a second payday loan on top of another one as promised. While you may honestly feel like you need the money, you need to look at what has happened in the past and realize that it’s probably not a good idea.

You may find payday lenders who do not have a credit rating requirement. However, you may learn that you’re not able to get a loan because you have a bad credit score. Not having any credit is a different situation than if you have poor credit. Remember your credit situation before applying for a loan.

It is important to recognize that a payday loan lender is going to ask for access to your bank account details. You should understand this fact and be aware of the dangers that come with it. Borrowing through an unrespectable lender could land you into more financial trouble than you might ever expect.

Before you get a loan, do some shopping around so you can get the best deal. Lending practices vary company to company. This ensures that you will be able to borrow the exact amount that you need.

Only go with a company that is honest about the fees and rates on cash advance loans. Stay away from companies who make it difficult to find out the fees associated with their loan’s cost.

If someone else requests that you get a payday loan for them, don’t do it. This could damage your financial health, which is something that you will want to keep intact.

Payday advances usually require the loan amount as well as interest. You need to make sure there is enough money to cover the loan.

Only adults can ask for a payday loan. The adult age is 18 in the USA. Only legal adults can sign loan agreements. This is the case, whether you are getting a payday loan in person or online.

While nobody should depend on payday advances between checks, they can help you when you have an urgent bill to pay. While it’s best not to go overboard, an occasional payday to help you get by during a rough period can be just what you need to get back on your feet! Keep the the information here in mind when you need a little help getting back on your feet!

If you think you want a payday loan, you need to go over the contract carefully. Your loan agreement will cover topics such as the interest rate, terms of the loan and the date the loan is due. It needs to be signed by you and a loan officer.