This article will reduce the chance that you’ll run into problems when dealing with payday loans.

Your choice of lender is critically important in your payday loan experience, so do your research. You will want to make sure the company you choose is legit, as well as ensuring they have solid policies in place for repayment. Read the reviews on a company before you make a decision to borrow through them.

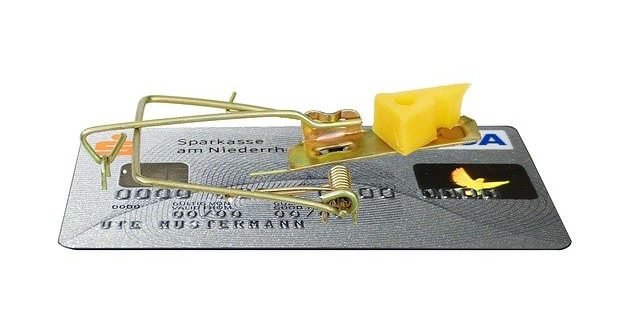

Payday Loan

Often, in order to be approved for a payday loan, there is a requirement that you possess a checking account. This exists because lenders typically require you to give permission for direct withdrawal from the checking account on the loan’s due date. The loan will be automatically deducted from your account on the day the loan comes due.

If you are thinking about taking out a payday loan, understand that you will be paying a great deal of interest with a payday loan. There are times where a particular company might have interest rate of 200 precent or more. These lenders get around interest rate limits that are placed.

If you can’t get the money you need through one company than you may be able to get it somewhere else. Your income level will greatly affect the amount of money that you get. The amount you earn will be factored in by lenders in order to calculate how much money you can get. You need to know how much you can repay before you actually get the loan.

There are lots of agencies that can offer you a payday advances. Look at any company and their service before you decide to get a loan from them.Be sure others have been satisfied customers in the past. You can usually find a company’s online reviews by looking online.

Don’t sign up with payday loan companies that do not have their interest rates in writing. Be sure to know when the loan must be paid as well. Without this information, you may be at risk for being scammed.

Don’t run around town and take out a dozen cash advance loans in an attempt to secure loans.

Before taking out a payday loan, research the lending company and see if they have a good history. Reputable and fair loan companies are out there, but there are just as many predatory companies, looking to scam you. If there are consumer complaints, see if the company responded.

Keep in mind that payday loan will have to be repaid very soon. You might need to make sure you will have enough money to pay the entire loan off in about two weeks. The only exceptions are if payday lands less than a week after you’ve taken out the loan. The loan won’t have to be repaid until the loan.

Don’t overuse payday loans. If you are in trouble, think about seeking the help of a credit counselor. Many people have been forced into bankruptcy with payday and cash advance loans. You can avoid this situation simply by avoiding payday loans.

Indirect loans come with additional fees because they add on fees for themselves.

Lying on the payday loan application will get you nowhere. You might think that lying will guarantee you to get the loan, but many payday loan providers make money from those who don’t have a good credit score, or whose jobs are not top notch. It can only damage your loan prospects if you put false information on the loan application.

It is a mistake to feel like you are in the clear once you get your payday cash advances. You must keep any paperwork close at hand so that you do not neglect to make timely payments. Failure to meet the deadline will result in being billed a lot of money.

Payday loans should be your very last option. These high interest loans can put you into a much worse financial situation if you aren’t smart. These loans offer little leeway for negotiation and carry stiff penalties for breach of contract. Find other ways of getting out of your financial hole if you can.

You should only consider payday loan companies who provide direct deposit. This is the most efficent way to go about it so you are not traipsing around with a lot of money on your person.

It’s very advantageous to establish a good relationship with your payday lender. Doing so lets you get the money you need when you have to take out another loan. Be certain to choose a good payday lender and stay loyal to that lender.

Know about payday loan fees are prior to getting one. For example, if you borrow $200, and the payday lender charges a $30 fee for the money. The interest on this comes out to nearly 400% per year!

Be sure to step back and give yourself a “cooling off” period for at least ten minutes before you sign off on a payday loan. In some cases, there are no other options, but you are probably considering a payday loan due to some unforeseen circumstances. Look at all available options to get much needed money first. Go ahead and apply for the loan if it is a necessary solution.

Do your research about any lender prior to signing anything. Make sure you work with a company that handles all affairs transparently and use historical data to estimate the amount you’ll pay over time.

Do not request another payday loan if there is an unpaid balance on a loan taken from another company. You may have a genuine financial emergency, but it should be obvious that you are digging yourself into a deeper hole with each new loan you take out.

It is likely you will be approved for more cash than you request, but you’ll have to pay even more interest on it.

Be aware that if you do not pay your payday loan back on time, the amount you go will go into collections. This will make significant bad marks on your credit report. Make sure that you will have the money when it is time to pay the loan back.

If you have several different loans, don’t ever put them all together.

Always be aware that payday loans come with high interest rates or large fees and are not usually the best option. Whenever possible, try to get a loan elsewhere, since interest rates on a payday loan can often reach 300 percent or more. If you want to take a payday loan, compare different options and select a legitimate establishment.

You may think you can simply skip a check over two pay periods. Payday consumers generally pay back in interest when all is said and done.Take this into account when you create your budget.

Your credit rating does not matter when you need a payday loan. Payday lenders just want to see your income to be sure you can repay the loan. Also, there are loan companies online that do not check your credit but instead will only verify employment. Usually one can expect to get around $700.

Keep an eye out for marketers that get paid to in order to associate you with a lender. They might show they are in one state, while representing lenders that operate in other countries. You might find yourself stuck in a loan agreement that could cost you originally wanted.

Don’t fill out an application for a payday loan until you know what fees you’ll be charged concerning the loan you want. Lots of lenders convince you to sign papers before you’re aware of the interest rate. If you do this, you are going to be held liable for the rate, regardless of whether you approve.

A simple method of selecting a payday lender is to read online reviews in order to determine the right company for your needs. This will help steer you figure out which companies are trustworthy and away from the scammers.

Try calling for a loan. It certainly is convenient to go on the internet and submit the online form, but calling can often yield superior results. You can ask questions and get more information about terms and conditions.

Make sure to check out all of your other loan sources before considering payday loans. Think about asking some of your friends or family for some funds; if you are not able to do that, friends or financial institutions for assistance instead.Payday advances can end up costing you a lot of money, so it is vital that you avoid them if at all possible.

Be sure to shop around when looking for a good payday loan. Think about asking your family, friends, a credit union or even your bank before talking to a payday loan company. The costs of payday loans can be very steep.

Cash advances usually require post-dated checks with the borrower to give them a check so that they can postdate it and take it out of your account. You need to make sure there is enough money in your account to cover the check on the specified date.

Review each of the fees and potential penalties before agreeing to any payday loan. Although payday loans can be issued extremely fast without much information on the loan application, the fees of this loan can significantly increase your debt. Be certain that you can pay the loan back as well as any additional fees required at the end of the term.

Only borrow as much as you know you can pay it back. You can’t assume that luck will help you can pay the loan. Any excess balance you have to carry forward will simply consume even more from your next paycheck.

Some payday loans have no paperwork requirements, though such loans may have other conditions that are tough to swallow. But it will cost more for the speedy service. You will be paying much higher fees, interest and associate costs than if you went with a different business.

What was your emotional reaction? Did you feel like a crisis? Or were you ecstatic because you had just scored fast money? If you react to payday loan money as if you are high, you might be in danger of payday loan addiction and should seek preventative help to avoid it in the future.

Select a payday lender that is well-known. Some companies have debt collectors employes who will try to intimidate you or your family, along with threaten you if the loan is not paid back promptly. You will be charged more fees by a company that is reputable if you are late on paying back your loan.

Hopefully, the tips featured in this article will help you to avoid some of the most common payday loan pitfalls. Keep in mind that payday advances are evil, but sometimes, they are a necessary evil if you need money and payday isn’t for a few days. The next time you’re looking to take out a payday loan, refer back to this article.

Always make sure to have required documentation when filling out a payday loan application. Neglecting to include required documents, like proof of employment and bank statements, will delay the loan process. You may lose a couple of days or more obtaining correct documentation.