There are times when events cause financial turmoil.Your paycheck may not suffice at a time like this. This is when a payday loan could be the best option. You can get all pertinent information before accepting an offer from a payday loan company.

If you are considering getting a payday loan, it is necessary for you to know how soon you can pay it back. The interest rates on these types of loans is very high and if you do not pay them back promptly, you will incur additional and significant costs.

You should contact the BBB for information from your local Better Business Bureau to make sure your payday loan company is operating properly.

Figure out what the penalties are for payments that aren’t paid on time. Naturally, if you accept a payday loan, you must be able and willing to pay on time. Nonetheless, the unexpected does have a way of happening. You should always read all of the provisions of the loan to find out what you are responsible for. Payday loan penalties are exorbitant.

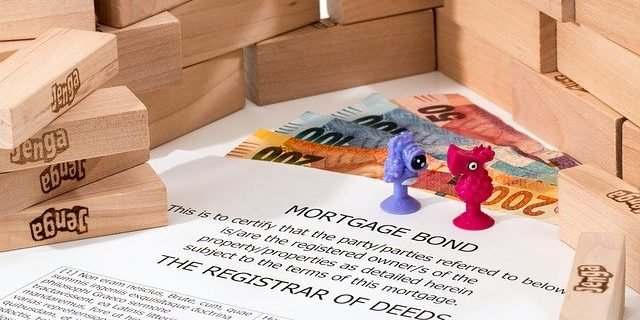

Payday Loan

Be careful of companies that have finance charges moved over to the next pay period. The problem is that borrowers tend to just continue paying such charges and the loan never gets fully repaid. It is not uncommon for borrowers to end up paying multiple times the loan’s starting value in this way.

Look into every type of fee that you’re going to have to pay when you get a payday loan. This will help you find out exactly what you’ll owe when you borrow the cash. There are interest rate regulations that are designed to protect consumers. Payday loan companies avoid these regulations by charging a person with a bunch of fees.This can really boost the amount of borrowing that money. This may help you decide if the loan is right for you.

When you’re trying to decide where you should get a payday loan, be sure that you select a place that offers instant loan approvals. Instant approval is simply the way the genre is trending in today’s modern age. With more technology behind the process, the reputable lenders out there can decide in a matter of minutes whether or not you’re approved for a loan. If you’re dealing with a slower lender, it’s not worth the trouble.

Watch out for companies that automatically roll over the finance charge to the following pay periods. This will cost you because you will be paying off the actual principle. It is not uncommon for borrowers to end up paying multiple times the loan amount.

When you repeatedly need to take out a payday loan to make ends meet, you may need to figure out how to gain control of your finances with the help of an expert. You can easily fall into the trap of repeatedly needing another loan, and it may be a continuous struggle to get out of debt.

If they have not gone digital, chances are they are not up to date with the latest technology and should be avoided.

It is smart to look for other ways to borrow money before deciding on a payday loan. For example, if you get cash advance on credit cards, the interest rate that you get would be a lot lower than if you took a payday loan. Consider asking for an advance at work or borrowing money from a family member or close friend.

Only go with payday lenders who have direct deposit. This is simple to do and helps you avoid having a bunch of cash in your pocket.

If you are thinking about accepting a loan offer, make certain that you can repay the balance in the near future. When the amount you require is greater than what you can repay at the specify day, it is better to research other avenues. You may even find a lender that is willing to work with you on repayment timetables and payment amounts.

Keep in mind that it’s important to get a payday loan only when you’re in some kind of extreme crisis or emergency. These types of loans can be difficult to repay and put you into a vicious cycle that is hard to escape. You won’t have as much money each month due to fees and interests and you may eventually find yourself unable to pay back your loan.

Do not borrow more money than you can pay for by the loan due date. Sometimes they’ll offer you more money then you need, but if you accept more than you’re positive you can pay back right away, then you’re just going to hurt yourself in the end.

Don’t avoid paying your debt from any payday loan providers. If you cannot pay your debt when it is due, you need to contact them and talk about an extension.

Do some comparison shopping. Compare online deals vs. in person payday loans and select the lender who can give you the best deal with lowest interest rates. Doing this could save you a lot of money on excess charges.

When applying for a payday loan ensure you go to the office make sure to have proof of employment as well as proof of age.

You need to establish a good payment history with the payday lender you are working with. This is important because it means you can get a future loan for the number of dollars you require. Stick with just one company and establish a history with them.

If you find yourself in a position with multiple payday loans, never get a bigger one to put them together.

Make sure you realize that any amounts not repaid will be turned over to a collection agency. Having a loan in collections will seriously lower your credit score, as well. You must be certain that you have enough money in the bank to cover your payday loan payment on the day it’s due.

You can never assume that missing a payment and that it will all be okay. Payday consumers typically pay a lot of money back double the amount they borrowed prior to going off on their own. Keep this in mind as you plan your budget.

Long before you sit down with a lender to secure a payday loan, you should understand and get comfortable with the fact that the interest rate involved is going to be exceptionally high. If you can borrow money from another source do it because you can pay up to three times what the loan was for. You might still want to do it, but you should know.

You will probably need to have some phone numbers when you get a cash advances. The payday loan office will need your telephone number for your home phone, cell number and probably the number for your employer as well. The might also ask for three personal references along with phone numbers.

When you need a payday loan, the modern way to handle it is to take care of the details on the Internet. Go with a lender that you trust, based on personal referrals or positive reviews. To apply, simply fill out the necessary forms. You should receive an answer within 24 hours.

Getting payday loan can be very seriously. It may lead to lots of bank and risking your credit rating if it isn’t handled properly. Always know that payday loan is not giving you extra cash. You have to pay it off in the future.

Before you sign any payday loan contract, review the lender’s fees thoroughly. Although payday loans can be issued extremely fast without much information on the loan application, the fees of this loan can significantly increase your debt. Ensure your budget allows for the payday loan to be paid in full by its due date.

If you’re self employed, it’s probably best that you don’t get a payday loan and look into a secured personal one. This is because cash advances generally aren’t granted to self-employed people. Payday loan companies operate on the premise that their lenders require proof of guaranteed future income.

You should only get a payday loan if you are in dire need of cash. They are not meant to help with the day-to-day living expenses. You should always try to get loans through traditional financial institutions before going the payday loan route, as these loans have good enough rates that you won’t get trapped in rollover hell.

Do your homework before signing up for a payday loan. You probably believe there’s not enough time to research if you need your money right now! Cash advances are appealing because they’re very quickly. You may be able to get money within 24 hours of your application. Look online for low rates, customer testimonials, and anything else that may affect you before you borrow money.

There are quite a few Internet sites where former customers report payday lenders that cheated them. Be certain to do a good amount of research. Look at these sites before getting a loan. This will ensure that the business is a real one and will not deal with you unethically.

You need to be careful of any scammers that are associated with the online payday loan industry online. Many times, scammers will use names that are very similar to reputable businesses, offering you quick cash over the phone and saying your credit hsitory does not matter. They will try to get your personal information for a variety of you.

You might be turned down by payday loan companies because they categorize you based on the amount of money you are making. If this leads to a decline being issued, then other alternatives need to be considered. You should be able to find another lender who will let you borrow a smaller amount of money.

There are a lot of sites you can find on the Internet where people have reported loan companies that have scammed them. Make sure you do your research. Look over these websites prior to getting a loan. This will let you know if your company is legitimate and not a particular lender is trustworthy or not.

Don’t allow any payday loan company to have free access to your bank account. If you are not able to keep up with payments, then you can set off a financially disastrous situation. Make sure your lender is going to get in touch with you in case a check bounces back.

Payday Cash

Before you choose to go with a payday loan company, do your research online or on the phone to find out your borrowing limit. Some companies may not offer you as much as you need. Doing your research will help you eliminate the ones who cannot help you.

Using payday cash advances on a regular basis is not a good idea, but they can help you make ends meet in an emergency. When used in the proper manner, they can be blessings for those in financial trouble. Keep these tips in mind to take advantage of payday cash advances.

Payday loans represent a substantial amount of business in today’s world. The reason for this is they are expensive and it is all profit for the lender. Do your research on each lender to get the best terms available. If there are any fees along with the interest, factor those into your loan’s cost too.