It can seem that you don’t have a friend in the entire world. Read this article to see if this is the best option for you.

Before you apply for a payday loan, make sure their BBB rating is good enough. You will be able to get information about their business and if they have had any complaints against them.

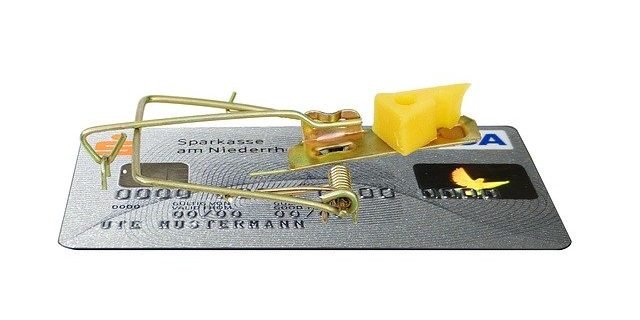

Payday Loan

Do some shopping around in order to get the best rates. Along with the traditional brick-and-mortar payday lenders, there are also a number of lenders online. Everyone wants your business, so they try to offer the most competitive terms. Many times there are discounts available if it is your first time borrowing. Do your research and compare lenders before you decide on one.

If you must consider a payday loan, understand that you will be paying a great deal of interest with a payday loan. There are some companies that will charge you an interest rates as high as 150% – 200% for extended periods.Payday lenders rely on usury laws.

A large lender will offer you better terms than a small one. An indirect lender will charge higher fees than a direct lender. This is because the indirect lender must keep some money for himself.

There are a lot of companies to choose from who will give you a payday loan. Look at any company and their service before you are considering. Be sure that there have been satisfied customers are pleased. You can usually find reviews by doing a web search.

Be sure you have cash currently in your account for repaying your payday loan. If they cannot get the money you owe on the due date, they will make an effort to get all of the money that is due. If you overdraft your account, your bank will charge you fees on top of the extra money you will now owe the payday lender. Always be sure that you have the money for your payment or it will cost you more.

Interest Rates

You should be mindful of the documents needed to apply for a payday loan. The two major pieces of documentation you will need is a pay stub to show that you are employed and the account information from your financial institution. Find out the information that you need to provide to make a safe and effective transaction.

Shop around prior to deciding on who to get cash from when it comes to payday lender. Some lenders will have better interest rates than others and also waive fees associated to the loan. Some services will give you the money right away, while some might have a waiting period. Shop around and compare interest rates to find the right payday loan for you.

Don’t avoid communicating with your payday lender if you know you will have trouble repaying. They will employ debt collectors who will call your references until you pay them back. So, if you can’t pay back your payday loan in full on the agreed payback date, you should contact the payday loan provider, and negotiate an extension.

Be on the lookout for scammers while shopping for payday loan scammers. There are those who pose as payday loan companies but actually want to steal your money.

Before signing a payday loan contract, check the BBB (Better Business Bureau) website, which is located at bbb.org. The payday loan industry has a few good players, but a lot of them are miscreants, so do your research. If you find complaints on the site, take note of the response from the lender.

You need to choose a payday loan company that offers direct deposit. This is the most convenient and safe since you don’t have to carry a lot of cash with you in this case.

Make sure you can pay your payday loan back within three weeks. If it will take longer to pay it back, then you need to find a better option. It may be possible to find other lenders who can give you more time to pay back your loan.

Check out the BBB’s website before you get a payday loan. Not all payday loan lending companies are created equally.

It is crucial that the day the loan comes due that enough money is in your bank account to cover the amount of the payment. Banks do not always make funds available the same day you make a deposit. If something unexpected occurs and money is not deposited in your account, you will owe the loan company even more money.

If you want to get a payday loan, you should ensure that all the details are in writing prior to signing a contract.

Payday loans carry an average APR of 651.79%. This is the national average, so state to state rats can vary somewhat. The loan you are interested in might not seem such a bad option, but you need to pay attention to the fine print and find out about any hidden fees. Sometimes you must read through the fine print to find this information.

Never accept a payday loan that is higher than you can reasonably pay back with your paycheck. There are some companies that tend to offer more than the amount you want so you will default and incur charges.That will ultimately mean more money for them.

Getting cash with a payday loan can be very serious. It can mean trouble at the bank and risking your credit rating if you do things wrong. Understand that you aren’t getting free money from a payday loan. Remember that you will have to pay it back with interest.

You must have several good phone numbers on hand to apply for payday loan. The payday loan office will need your telephone number for your home phone, cell and work number before they proceed. Most payday loan companies want to know the names of three other people you to give them some references.

If a majority of your income is from self employment, then you may have problems getting a payday loan. Many companies don’t see self-employment as reliable income, so they might reject your request. Do some online research, and you may find a lender that makes payday loans to the self-employed.

Read consumer reviews and check them out with the Better Business Bureau. It is important to read the privacy policy for any site you use.

Check online review sites to learn if a payday loan institution has a good reputation. Personal recommendations are good indicators for a reputable lender.

Although these loans usually do charge a higher fee than other loans, it is important that the interest charged is customary.

It is important to remember that a payday loan should be used only as a short-term solution. If you continually rely on payday loans, you may need learn to budget your money better.

You can look online for a payday cash advances on the Internet.You can often fill out the paperwork online and you should hear from them in about 1 day.

Determine the true cost of taking out a payday loan. Although there is a lot of press given to the high cost of these loans, sometimes you really just need the money. The amount given in such a loan is normally under two thousand dollars. Usually, you’ll pay from 15 – 30 dollars for each 100 dollars borrowed. Make sure you take all of this into account before taking out a loan. If you can’t afford the interest, then you can’t afford to get the loan.

Don’t sign a contract until you carefully read it thoroughly. Read the terms of the loan and ask any questions you have. Look for hidden fees.

Reconsider refinancing payday loans. Refinancing a payday loan results in excess fees. Payday lenders charge very high interest rates, so even a couple hundred dollars in debt can become thousands if you aren’t careful. If you are unable to repay the payday loan, consider an inexpensive personal loan from the bank, instead of refinancing the payday loan.

Before accepting a payday loan, it is important that you understand the interest rates being charged as well as any fees associated to it. You can avoid any surprises by simply thoroughly reading the terms and conditions.

Try to not chose a lender that has fees that go above 20 percent of what you have borrowed. Payday loan rates are quite high, but they should never be higher than this benchmark.

This will save you fully understand the details of the loan. Read all the fine print to understand what you are getting into.

Some payday loan companies do not make you hand in any paperwork; be careful of these kinds of lenders. Faster processing means you’ll be paying through the nose for an already expensive loan. The costs and fees will, in general, be above the industry average.

Getting a cash advance loans shouldn’t be your primary resource when you need money. It is okay to use this resource occasionally, but doing it more than once can become dangerous.

There are a lot of online sites where consumers expose scam payday loan companies. You need to be diligent in your research. Check into a payday loans company, their reputation and their standing with the Better Business Bureau. This will help you to determine whether or not a company is out to rip you off.

If you’re denied the loan, ask why. It might just be something as basic as your boss not picking up the phone. Once you know what happened, you can remedy the situation. This lets you get the money that you require.

Some payday lenders say that no credit is required for their loans. Sometimes though, you can be denied due to poor credit. Sometimes having no credit can be a negative thing, just as bad credit is, but they are different situations entirely. Remember your credit situation before applying for a loan.

You should know how a payday loan can hurt or help your lender will report to the major credit agencies. You shouldn’t expect your credit score to improve when if you pay your loan off quickly, and you should be aware that late payments can give you a lower score. Make absolutely sure you will be able to pay your payday loan back by the time it is due.

If you’re someone who has had to take out a payday loan in the past, picture that time and think about what it was like to get the money. What was your reaction? Was there relief at having avoided a financial crisis? Did you get a little rush from scoring quick, easy money? Once you get a payday loan, it can lead to a another and the cycle only gets you deeper in debt.

Before you think that you can’t afford to get a payday loan, try to understand how much your budget is. Be aware of the amount you require to pay for your bills and expenses. You do not consider this money when deciding. You should base your loan figures off of the surplus money you have left over once your bills and other expenses are met. To be safe, don’t borrow any more than a quarter of your whole paycheck.

When you are thinking of getting a payday loan, resolve to developing a budget you can stick to. It’s easy to overspend if you don’t keep an eye on your pennies.

Never get a payday loan out for someone you know. Even if you want nothing more than to help a friend, it’s not a good idea to put your name and credit at risk just to give someone some help.

Payday loans are frequently scoffed at by the financial industry. The fees and interest rates are quite high, so you should be cautious before taking out this kind of loan. If you look into a company before borrowing money, you will be more likely to get the cash at a reasonable rate.

This will allow them to rectify any problem and perhaps offer a better deal. If you are still unsatisfied, contact your local Better Business Bureau or other government agency to file a complaint.

If you are self-employed, find out what paperwork you need for a payday loan. Many lenders have different procedures for use with self-employed borrowers. Consider calling up customer support and get a person to assist you in filling out this paperwork so that you won’t make any errors.

Do not assume that you have won with a payday loan.Your lender likely has terms and regulations of the payday loan and other ways they can charge you fees. Setting these off could have a snowball going that winds up being your life.

Try to get a small loan from a bank before you resort to getting a payday loan. While the application process may be lengthier, the interest rates are usually far lower than the rates of payday lenders.

If you feel uncomfortable, do not apply for it.

If you choose to get a payday loan, try to get it in person as opposed to getting it online.

Most reputable lenders will not give you to apply for a loan by simply calling them. You may need to go online in order to submit an application. After you have completed the work through their website, you can finish up any other business by phone. You will also then speak to customer service team over the phone with any questions you may have.

By doing everything the right way, you will surely have a simpler experience when dealing with payday loans. You can pick the best lender, get the ideal amount, and pay the money back quickly. Using these suggestions will help you make the best choices for your situation.